Estimating Beta: Log or % Returns?

Almost all calculations in finance involve using log returns rather than % returns. There are a number of reasons why log returns are preferred. Estimating beta doesn’t seem like a special case.

But when you go through the math, something doesn’t quite add up.

\[\begin{align*} r &= \alpha + \beta \, r_{M} + \varepsilon_t \\ S_{1} &= S_0 \, exp{\left ( r \right )} \\ M_{1} &= M_0 \, exp{\left ( r_{M} \right )} \\ P_t &= S_0 + w \, M_0 \end{align*}\]Because we want to zero out market risk, so want to solve for \(w\) such that \(r_{M}\) is no longer in the equation below.

\[P_{1} = S_0 \, exp{\left ( \alpha + \beta \, r_{M} + \varepsilon_t \right )} + w \, M_0 \, exp{\left ( r_{M} \right )}\]After going through this, the math quickly gets very messy.

If we use % returns, the math is alot cleaner.

\[\begin{align*} S_{1} &= S_0 \left ( 1 + r \right ) \\ M_{1} &= M_0 \left ( 1 + r_{M} \right ) \\ P_{1} &= S_0 \left ( 1 + \alpha + \beta \, r_{M} + \varepsilon_t \right ) + w \, M_0 \left ( 1 + r_{M} \right ) \end{align*}\]After some basic algebra, we find that \(w = \beta \frac{S_0}{M_0}\).

Indeed beta should be calculated using % returns.

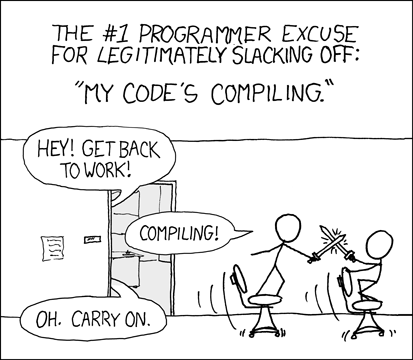

So there you have it. Time to change some code.